Personal Debt Management Program

Empower Your Employee's Financial Wellbeing and Strengthen Your Business.

When employees are stressed about paying their bills and managing overwhelming debt, their focus and productivity suffer. Mistakes increase, efficiency drops, and ultimately, your bottom line is affected.

Our Personal Debt Management Program is a FREE solution (at no cost to your business) designed to support your team through your HR Benefits Package.

Why Our Program Stands Out:

100% Confidential:

Employees can participate without fear of judgment.

Easy to Access:

Simple onboarding and user-friendly resources.

Comprehensive Debt Assessment:

A personalized analysis to understand their financial situation.

Tailored Solutions:

Four proven debt management options to reduce debt and create a manageable repayment plan.

Credit Rebuilding Strategies:

Tools to rebuild financial stability and plan for a secure future.

When your employees have peace of mind about their finances, they can fully focus on their work, contributing to a more efficient and engaged workplace.

Take the first step towards a happier, more productive team.

Contact us today to learn more about integrating this benefit into your HR package!

Benefits of Providing a Debt Elimination Program for Employees

Implementing a Debt Elimination Program as part of your employee benefits package offers significant advantages for both your organization and your workforce

For Employees:

1. Improved Focus and Productivity:

- With fewer financial worries, employees can better focus on their assigned tasks and responsibilities.

2. Debt Management Options:

- Tailored plans help employees address their unique financial challenges effectively.

3. Improved Credit Scores:

- Structured debt repayment plans support credit score improvement, opening opportunities for better financial stability.

4. Increased Job Satisfaction:

- Employees value employers who prioritize their well-being, leading to higher morale and job loyalty.

5. Confidential and Accessible Support:

- Employees can participate without fear of judgment or stigma, ensuring privacy and ease of use.

For Employers:

1. Enhanced Productivity:

- Financially stable employees are more focused, efficient, and less prone to errors.

2. Reduced Absenteeism:

- Stress-related illnesses and distractions decrease, resulting in fewer missed workdays.

3. Lower Turnover Rates:

- Employees are more likely to stay with an employer who offers meaningful financial wellness support.

4. Cost-Free Solution:

- The Synergy Personal Debt Managment program including debt elimination services, are offered at no cost to you, the employer.

5. Positive Workplace Culture:

- Financial wellness programs contribute to an overall supportive and inclusive company culture.

The Bottom Line:

A Debt Elimination Program isn’t just an employee perk—it’s a strategic investment in your workforce. By addressing financial stress, you're creating a healthier, more focused, and more productive team, ultimately driving long-term business success.

Empower your employees financial wellbeing. Strengthen your business.

Get Started Today!

Need more proof that your team would benefit from our Personal Debt Management program?

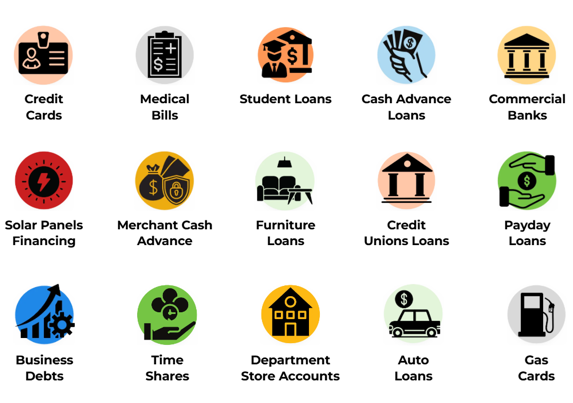

U.S. households carry a substantial amount of unsecured debt, primarily in the form of credit card balances and personal loans. Here's a breakdown:

Credit Card Debt:

Total Balance: At the end of 2023, Americans owed a record $1.13 trillion in credit card debt.

Average Balance per Household: In 2023, the average credit card balance per household was approximately $6,501, marking a 10% increase from the previous year.

Personal Loans:

Total Debt: In the fourth quarter of 2023, the total debt from unsecured personal loans reached $245 billion.

Number of Borrowers: Approximately 23.5 million Americans had unsecured personal loans during this period.

Average Debt per Borrower: The average debt per borrower for unsecured personal loans was $11,773.

Average Non-Mortgage Debt per Individual:

In 2024, the average personal debt among U.S. adults, excluding mortgages, was $22,713, with 66% of respondents indicating they held at least some debt.

These figures highlight the significant levels of unsecured debt your employee households are facing, which can impact financial stability and stress levels. Give them an HR benefit to ease their worries and build a stronger relationship with your company.

Schedule a FREE appointment to explore how simple it is to adopt this program as part of your HR benefits package.

Real Stories, Real Results

"I cannot begin to tell you the relief we feel from signing up with Debt Navigator! They have stopped the calls and give us peace of mind to concentrate on more important things that come up! Thank you, Debt Navigator, for our peace of mind."

Debt: $19,555.00

Monthly Payment: $514.00 → Now: $263.33

Adjustment: 48%

- M.W.

"I am so thankful we found My Debt Navigator. My husband and I were struggling with his federal student loans after we had to start paying again after COVID, and they were able to get us a lower payment and shorter repayment."

Debt: $27,800.00

Monthly Payment: $410.00 → Now: $194.75

Adjustment: 62%

- K.P.

"My Debt Navigator helped me so much to get rid of my credit card debt and my personal loans. I will be saving so much money each month that now I feel I can pay off my debt even sooner so I can save more money for retirement. Thank you for helping me with this."

Debt: $32,262.00

Monthly Payment: $892.00 → Now: $393.66

Adjustment: 55%

- D.A.

"I'm so relieved to have My Debt Navigator's help! What once seemed like an overwhelming federal student loan is now manageable. The specialist was incredibly thorough, took the time to answer all my questions, and made sure I felt completely comfortable with the process."

Debt: $57,000.00

Monthly Payment: $360.00 (for 10 years) → Now: $250.00 (for 3 years)

Adjustment: 79%

- K.A.